It’s been five years since the COVID-19 pandemic washed over the United States. When the World Health Organization declared the pandemic, the start of many changes in the healthcare industry developed (some temporary, some permanent). Many of the long-term impacts still remain to be seen. So, in five years, how has the healthcare staffing industry fared? What does the healthcare staffing industry’s future hold? This article will cover various topics within the industry, including demand for travel and locum tenens, overall industry recovery, where the staffing healthcare industry is going, and more.

Demand for Travel

When the COVID pandemic was at its peak, per diem and travel nurses were crucial in helping to keep understaffed and overburdened health systems running. But with the healthcare system leveling out and becoming more stable since the pandemic, the demand for shorter-term contract labor decreases.

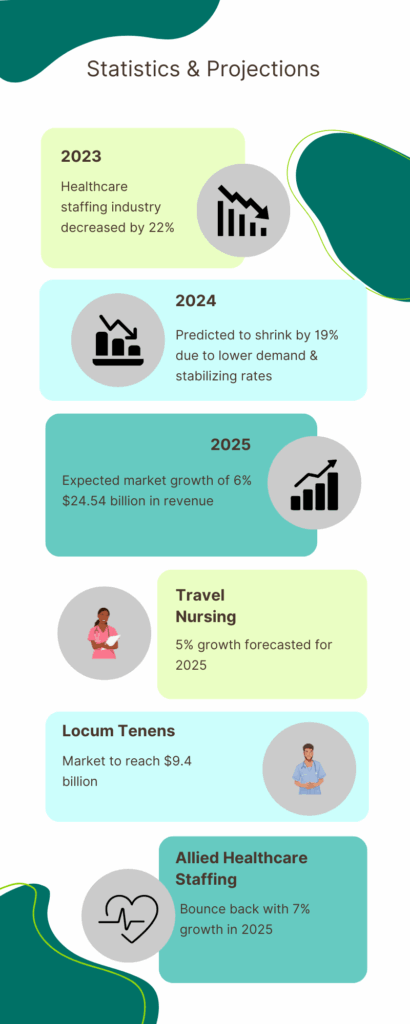

While the pandemic was running rampant in the US, travel nurses made $4,000 a week, and now in 2025, the average nurse only makes $2,300 a week. The Staffing Industry Analysts reported that the revenue dropped by 37% in 2024 alone, and the per diem nursing market decreased by 17%. Some hospitals are even cutting or restricting internal travel nurse programs.

However, even though healthcare staffing firms are now scaling back operations in order to match the reduced demand, healthcare providers forecasted 5% growth for travel nursing this year. An article from Definitive Healthcare states that “According to Mercer, around 73% of U.S. states have a surplus of registered nurses, reducing pressures that necessitate contract hiring. But with most states facing a deficit of nurse practitioners, nursing assistants, and home health aides, it’s unlikely that demand for travel nursing will fall below 2020 levels anytime soon. For now, market data firm WifiTalents projects a CAGR of 5.8% for the U.S. travel nursing industry from 2023 through 2028.”

Locum Tenens Staffing is Growing

Driven by physician shortages and increased demand for specialized care, locum tenens are in high demand. Especially with the aging US population, more demand for advanced roles like nurse practitioners and physician assistants, the locum tenens market is projected to achieve $9.4 billion this year.

Locum tenens physicians have been able to maintain their normal billing rates, as they are pivotal as revenue drivers. This part of the healthcare staffing industry grew by 15% in 2024, and will continue to grow as the need for physicians and advanced practice providers is being driven by the growing aging population, patient volumes, and an increase in health conditions in the younger population.

Mergers & Acquisitions in the Healthcare Staffing Market

The following list holds information about notable staffing firm mergers/acquisitions to be on the lookout for in 2025. M&A activity allows healthcare staffing firms to gain new resources and clients, enabling the industry to grow.

Aya Healthcare has a $615 million deal to acquire Cross Country Healthcare, which will help to deliver Cross Country’s clinical services in nonclinical settings, like schools and homes.

TrueBlue, traditionally an industrial staffing firm, entered the healthcare industry by acquiring Healthcare Staffing Professionals. Healthcare Staffing Professionals specialized in travel nurses, allied healthcare, and behavioral health staffing.

A national healthcare staffing firm, Care Cooper, picked up four smaller firms: Next Move Healthcare, MedUS Healthcare, Amare Medical Network, and Alliant Personnel Resources.

These acquisitions will help the healthcare staffing agency grow and grant them points of access within untapped markets.

Public Health in the Spotlight

Due to the COVID-19 pandemic, the healthcare industry and system has stepped into the spotlight of the world. Healthcare experts agree that the system is far from perfect, but it’s been able to become nimbler than it was before.

Healthcare workers learned how to adapt, whether it was by learning rapidly adopting changing protocols or infection control guidance, or by learning the value of collaboration with their fellow healthcare workers. More than 100 organizations have joined the Common Health Coalition, hoping to strengthen the partnership between healthcare and public health systems, especially when it comes to emergency preparedness, disease surveillance, and data sharing.

“The pandemic’s early days were an especially scary and uncertain time. Americans turned to public officials for reassurance and clarity. Health departments were key to coordinating the COVID emergency response, working alongside trade groups and providers to keep the public informed,” said an article from Fierce Healthcare.

Unfortunately, healthcare being in the spotlight hasn’t led to all good things. Trust in healthcare has been severely damaged, violence against healthcare workers is on the rise, and vaccine rates among kids are dropping.

But with the bad, comes the good. Organizations introduced programs to support the mental well-being of their workers. Innovative staffing models sprung up and embraced virtual practices and flexible scheduling. Staffing technology platforms help fill positions quickly using self-service tools and automation, and they make up 22% of the market and continue to expand. Telehealth services and administrative tasks have the ability to be remote positions, widening the talent pool and allowing staffing firms to recruit from anywhere in the country. With the rise of technological use in the healthcare industry, patients now get to choose from a range of options to receive care: in-person, video call, phone call, or a chat box. Automating administrative workflows could also benefit the industry and could reduce staffing demands by 15% to 35%.

Where is the Healthcare Staffing Industry Going?

It’s estimated that over 6.5 million healthcare professionals may leave the workforce by 2026, causing a huge 4 million worker gap. 3B Healthcare wrote that “The U.S. Census highlights that by 2029, 73% of those aged 65+ will need increased healthcare services. Simultaneously, many current practitioners—especially RNs—approach retirement. This dual-front pressure bolsters the healthcare staffing shortage, calling for renewed recruitment and retention strategies.”

There are recommendations and solutions that could help staffing firms fight the shortage:

- Competitive compensation and benefits: pay structures, adjust for rising operational costs.

- Flexible scheduling and work-life balance: 96% of healthcare leaders say flexible options improve morale

- Career development and training: use mentorship, onboarding, and simulation to boost retention.

- Support workplace culture: open communication and wellness programs help with burnout.

- DEI initiatives: expand career pathways for underrepresented groups.

- Strategic recruitment: collaborate with educational institutions and mentorships.

EZ Staffing Factoring is a sister website of Factor Finders. Factoring your staffing firm’s invoices could help with payroll, operational costs, and more. Contact us today for a free factoring quote.