Fast growth is the goal of every staffing agency—but growth exposes a financial reality many firms aren’t prepared for. As placements increase, payroll obligations rise immediately, while client payments lag 30, 45, or even 60+ days behind.

For high-growth staffing agencies in 2026, this timing mismatch makes one thing clear:

Traditional bank loans aren’t built for the way staffing agencies grow.

That’s why many fast-growing firms turn to invoice factoring instead.

The Growth Paradox in Staffing

Staffing is a cash-intensive business by design:

- Workers must be paid weekly or biweekly

- Clients often negotiate long payment terms

- Growth increases payroll faster than cash collections

Ironically, the faster a staffing agency grows, the more pressure it puts on cash flow. Without the right funding structure, success can quickly turn into constraint.

Why Bank Loans Fall Short for Staffing Agencies

Bank loans and lines of credit are built for predictable, asset-heavy businesses—not payroll-driven service firms.

Common Limitations of Bank Financing

1. Fixed Credit Limits

Bank lines don’t automatically grow with revenue. Once you hit the limit, growth stalls until the bank approves an increase—often months later.

2. Lengthy Approval Processes

Staffing agencies need funding quickly to respond to client demand. Banks move slowly, especially during economic uncertainty.

3. Restrictive Covenants

Debt covenants may limit hiring, client concentration, or expansion—exactly what fast-growing agencies need flexibility for.

4. Collateral & Personal Guarantees

Many banks require hard assets or personal guarantees, increasing owner risk without solving payroll timing issues.

What Invoice Factoring Does Differently

Invoice factoring converts unpaid invoices into immediate working capital—aligning cash flow with payroll instead of client payment delays.

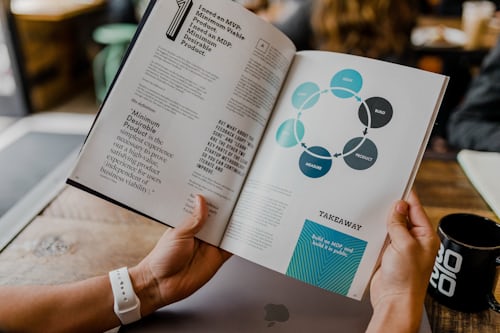

How Factoring Works for Staffing Firms

- Workers are placed and invoices are issued

- Invoices are submitted for factoring

- Cash is advanced quickly (often within 24 hours)

- Payroll, taxes, and operating costs are covered

- The balance is settled when the client pays

Funding increases as invoice volume increases—without renegotiation or reapproval.

Why Fast-Growing Staffing Agencies Prefer Factoring

1. Funding Scales Automatically With Growth

More placements = more invoices = more available funding. There’s no artificial cap slowing momentum.

2. Growth Decisions Stay Strategic

Agencies can pursue enterprise clients, seasonal surges, or new verticals without worrying whether cash can support payroll.

3. Speed Matches Staffing Reality

Factoring provides rapid access to cash—critical when payroll deadlines don’t wait for bank committees.

4. No Long-Term Debt on the Balance Sheet

Factoring isn’t a traditional loan. Agencies access their own receivables rather than taking on fixed debt obligations.

5. Reduced Owner Stress and Personal Risk

Owners no longer need to rely on personal credit cards, emergency loans, or delayed compensation to fuel growth.

A Common Pattern Among High-Growth Staffing Firms

Many agencies follow this trajectory:

- Start with personal capital or a small bank line

- Grow quickly and hit a cash flow ceiling

- Experience payroll stress despite strong sales

- Switch to invoice factoring to unlock growth

- Scale confidently without funding constraints

Factoring isn’t a fallback—it’s a growth accelerator.

The Hidden Cost of “Cheaper” Bank Loans

Bank loans may appear less expensive on paper, but the real cost is often opportunity lost:

- Clients turned away

- Recruiter hiring delayed

- Market share surrendered to better-funded competitors

Fast-growing agencies prioritize access, flexibility, and speed over headline interest rates.

Why Invoice Factoring Fits the Staffing Model in 2026

In 2026, staffing agencies face:

- Longer client payment terms

- Higher wage pressure

- Tighter bank underwriting

- Increased competition for talent

Invoice factoring is designed for businesses where receivables—not equipment—are the primary asset.

Final Thoughts: Growth Requires the Right Capital Structure

Fast-growing staffing agencies don’t fail because they lack demand. They struggle when funding doesn’t scale with opportunity.

Bank loans are static. Staffing growth is dynamic.

Invoice factoring gives staffing firms the flexibility to:

- Pay payroll on time

- Take on larger clients

- Scale recruiter teams

- Expand without fear of cash flow shortfalls

That’s why, in 2026, many of the fastest-growing staffing agencies choose invoice factoring over traditional bank loans.